Wine has always been a popular drink and for many the fermented beverage of choice. In most cases whether you prefer Red or White, or even a Rose, experts and connoisseurs believe that any wine is best stored and served chilled.

So, you may well ask what is the difference between a wine served warm, or chilled, and does it really matter if the wine is warmer than expected, or even hot? Some wines are indeed served hot and are even used in cooking, but why is it important if it gets hotter than anticipated before it gets to the consumer?

Well, from an article in WinePair ™ a short time ago it was stated that; wines do change when they are subjected to a high temperature. Firstly, the tannins become 'more noticeable and wines take on a tangy, astringent character. Instead of a smooth and supple mouthfeel, wines feel rough and more one-note on the palate. Fruit flavors often become secondary to unpleasant acidity. In dry climates, corks shrink as they lose moisture, leading to leaky bottles and a sticky mess.'

This is all well and good, but at above what temperature would there be any noticeable change to the wine we drink?

Any wine should normally be stored between 55 – 65ºF (13-18ºC) and wine should be stored in a cellar, or a wine refrigerator, that maintains this recommended temperature level. And, it is generally noted that the change to the body of the wine begins at 70F (21C), and wines can “cook” as exposure temperatures hit 80F (26ºC) degrees and beyond. However, an occasional spike won’t decimate a wine, but prolonged exposure — like a week-long heat

So, what is an acceptable solution for making sure you can tell that

Timestrip offers a full range of stock labels including two that have a temperature breach of 20ºC and 25ºC (tolerance +/- 1ºC), and Timestrip can also produce a custom and branded label that can be set to monitor more specific temperature breach limits.

So, in the future be on the look out for some form of temperature indicator label on the bottle of wine that you buy to ensure that it has been kept at the recommended temperature to insure you get the most enjoyment from the wine that you buy and drink.

The big word in the logistics and supply chain “world” is RISK, and a risk assessment being performed, or at least having a mitigation plan in place, is becoming part of many certification requirements, like ISO 9001, and other pending or recently introduced federal regulations.

It will be no surprise, I am sure, when I mention certain facts like – “Where humans are involved in a process there will be errors, and 90% plus of all supply chain errors are human errors”; but how do you avoid these?

Firstly, let me say there will always be Risk not only in the common elements of the supply chain but also and especially with the way that you handle any cold chain or temperature-controlled products.

So how do you manage these risks?

There are 4 common and accepted ways that Risk can be managed, or mitigated:

- Risk Avoidance: Changes made to your processes and players that ensures risks are no longer an issue.

- Risk Mitigation: Reduce the severity of the loss or prevent the likelihood of the risk from occurring.

- Risk Acceptance: Avoidance of a potential risk area is not possible or economically feasible, so it is acceptable and will not impact your business.

- Risk Deflection: After the risk has been identified and quantified, transfer that risk to the control of another player or partner in the process – maybe add it as a clause to be addressed in a vendor contract.

So how do you establish a Risk Mitigation Plan?

- Review and audit your supply chain to assess where risk does, or may exist

- Assess what the impact of these risks may be and create a list with the highest probability items at the top to address first

- Define your risk mitigation strategies for the highest-level items and work down the list from High to Low

- Implement the strategies and document them.

What else should I do, or know?

- Even though your Risk Management plan includes good SOP’s and WI’s make sure that people are adequately trained in these disciplines

- Conduct self-audits regularly

- The cost of a Cold Chain Monitoring device or solution, is far less expensive than the cost of disposal of a temperature compromised shipment

- All Quality Systems and Risk Aversion Plans should have one over-arching goal – Quality of Product and Consumer Safety!!!!

At Timestrip we are acutely aware of all kinds of risks that can exist in all kinds of supply chains from Pharmaceutical to Food and even beyond to special chemicals and laboratory testing time lines.

For a full range of our products please visit our products page

Time and distance are the twin challenges when managing cold chain logistics for the transportation of fresh food perishables

Fruit and vegetables, packaged salads, dairy produce, eggs and even flowers – consumers the world over depend on supply chains that can bring perishable goods to retailers’ shelves speedily and in the best possible condition. Their instantly made purchasing decisions depend on products looking as appealing and unblemished as they do in promotional advertising.

At Timestrip, we see this every day. One of our aquaculture clients uses our Irreversible Time and Temperature Indicators in the export of seafood to the US market. He reports that how his products look upon arrival directly impacts on whether a delivery is rejected or not. His use of Timestrip smart labels ensures that his cold chain management processes guarantee not only that his products are safe after transport, but also look fresh to the end-user. (Read our Ferme Marine de Mahebourg case study)

Moreover, this need for efficient transport processes that guarantee product quality at the point of sale is playing itself out against a backdrop of rising worldwide consumer demand for perishable goods as per capita incomes rise in major markets such as China and India.

A general rule of thumb in the global food trade is that lower per capita income nations tend to import mostly grains, while higher per capita income nations import a wide range of cold chain perishables. So, while 70% of foods consumed in the US are managed by cold chain processes against only 25% of the meat and 5% of the fruits and vegetables in China, for the latter these figures are rising rapidly.

Also, within developed markets, the demand for perishables is rising. According to Winnesota Regional transportation, the US refrigerated transportation market on which the sale of perishables depend is growing at a rate of around 12.5% per annum, with strong projected growth in the coming years.

Projected annual growth in global cold chain to 2020 - 13.9%

Fresh produce shelf-life time spent in transit- 50%

Source: Logistics Bureau

Although regulation around safety is an important factor in the growth of cold chain transportation, globalisation and innovation play a far more important role. Technological progress around refrigerated transport makes it possible for less developed economies to sell their perishable produce in far away markets.

Complex international supply chains

As soon as a flower is picked or a fruit and vegetable is harvested, it begins to rot. Time and distance are thus the twin challenges of the fresh cold chain.

In fact for some produce such as Guatemalan bananas that picked when they are green, this biological process occurs during transit thus ensuring they arrive at retailers in the EU and the US in a saleable condition.

To avoid product spoilage, speed is the number 1 priority. Cold chain processes are therefore equipment and technology intensive in order to prolong freshness so consumers get to buy saleable produce.

Other considerations include:

- product sensitivity to weather and other naturally occurring disruptions

- the maintenance of sound sanitary practices from producer to retailer

- the requirement of specialised handling and packaging

- accurate labeling and traceability

Faster supply chains

An increasingly common feature of making perishables supply chains faster is for major supermarkets to take total control of this process with acquisitions of farming production facilities and the development of close business relationships with growers.

In the UK, the supermarket chain Morrisons is also one of the country’s biggest food manufacturers, with over 20 nationwide food production and distribution sites. The group says that more direct links with its farmers enable it to deliver the freshest food and best value to its customers.

Vertical supply chains also allow for growers and farmers to earn more from their produce. This happens in France with the supermarket chain Intermarché whose close relationships with dairy farmers ensure that they are paid 50% of the retail sales price of a litre of branded milk.

From farm to supermarket shelf

The Leckford Estate in Hampshire, southern England, is the Waitrose supermarkets farm that supplies its produce to Waitrose stores across the UK

Keeping the fresh cold cold chain cool

Although speed is essential in ensuring that the transport and delivery of perishables avoids spoilage, temperature control is another vital component in guaranteeing fresh cold chains.

“Maintaining the cold chain is one of the most effective ways to ensure safe, quality food”

Jorge Hernandez, Senior VP, food safety and quality assurance, U.S. Foods

The complexity of the required processes has led to the food companies working increasingly with specialist third party suppliers and the requirement of suitably qualified personnel.

Another key cold chain area for temperature monitoring revolves around equally specialist technologies, such as RFID tags that record and forward real-time temperature data, real-time GPS tracking that provide visibility of shipment progress, and a range of high-tech time and temperature monitoring solutions.

Avoiding waste due to spoilage

Fresh produce spoils easily and in many cases this is only identified at the very end of the transportation cycle, leading to either shipments being rejected or consumers claiming refunds from retailers. Moreover, apart from waste caused by the spoilt produce, further costs are incurred related to transporting these products that will never be consumed.

For companies, these have a big impact on their financial results. Timestrip Irreversible Time and Temperature Indicators are currently being used by a number of companies to address this issue. In the US for instance, the rail carrier Amtrak has integrated Timestrip products to successfully reduce food waste of its on-board catering services. Read our Amtrak case study.

At an industry level, a new vision about how to reduce these costs is around the establishment of "lean practices" whereby handling by various stakeholders in a perishables supply chain are kept to the very minimum. This is part of the thinking behind supermarkets taking control of food production mentioned above.

A strategy in this area includes a focus on direct-stores deliveries that avoid traditional centralised distribution methods and the maintenance of smaller local fresh produce warehousing much closer to retail outlets.

Significant savings can be also generated with appropriate packaging that protect fragile perishables against damage and innovative materials that actually extend the life of produce by controlling its life-cycle with the use of ripening agents such as ethylene gas.

This can involve speeding up the ripening process with innovative packaging containing ethylene gas capsules that can ripen fruit on demand, and ethylene gas that is used to ripen green bananas during transportation. It can also involve slowing down the ripening process with the use of ethylene absorbers that are added to fruit packaging.

A growing area of cost savings in fresh supply chains is the use of returnable plastic crates (RPCs) that can be used many times.Their ergonomic design allows for space-saving stacking, safer handling and ventilation and draining hat reduces in-transit spoilage. Plus with so-called "one-touch merchandising", RPCs placed directly onto shelf displays,further reducing handling.

They also have an impressive environmental record: a 2013 study found that RPCs generate 82% less waste, consume 92% less water, cause 76% less ozone depletion and require 49% less energy.

Managing the fresh cold chain

Franck Artis is the Singapore Branch Manager of Food Distribution Pte Ltd. He says:

For perishables such as dairy produce, it is essential that the cold chain is not breached during transportation, with an ideal temperature range of 3°C to 4°C. This is just as much for product quality as for food safety. Normally this must involve some kind of refrigerated transport.

For domestic transport such in France, this involves refrigerated lorry deliveries direct to retail outlets or (often regional) distribution platforms that have dedicated cold rooms for temporary storage. For export, this can involve either a transporter operating door-to-door processes or alternatively outsourcing this function to third-party cold chain logistics suppliers.

A key feature of cold chain management during the maritime transport of perishables is the ability of transporters to supply accurate and complete temperature data that shows that the cold chain has not been breached. This can mean using reefer containers with temperature tracker boxes that monitor and control the temperature inside the containers, and log and respond to any breaches, say, in the event of a temporary power outage.

The economics of the transport of perishables dictate that temperature monitoring tools such as Irreversible Time & Temperature Indicators would only be used for high added value items, such as caviar, rather than a carton of yogurt or milk.

For perishables such as flowers, avocados, bananas and tomatoes, transit time is used a ripening period to ensure that when they arrive at their final destination (retail) point, they are fit for sale.

The advent of the banana cold chain

Bananas make up the largest share in the transport of perishables, equivalent to approximate 20% in volume and worth some US$8bn in 2013.

Exact figures of global banana production are difficult to determine as globally only 15% of production (which include plantain) is exported and much of what is not exported is produced by small or very small growers.

Nevertheless, refrigerated cargo (aka reefer) ship technology has been an important driver in the cold chain technology development. The first reefer ship for the transport of bananas was developed in the US in 1902 by United Food Company.

Up until that point, bananas were a highly exotic fruit and very much a luxury item in non-banana producing nations.

Today, it is one of the world's most consumed fruit and due to its distinct ripening process, the trade and transportation of this produce has led to distinct term in cold chain logistics – the so-called 'banana cold chain'.

Whether it’s Chilean blueberries for breakfasts in London, French-made polio vaccines for use in Malawi, or Mauritian sea bass for restaurants in the Big Apple, the chances are that all these cold chain perishables have been transported by air.

Indeed, thanks to our increasingly connected world and rising incomes in developing nations, consumers across the globe are opting for perishables produced far from where they will be consumed. Since 2010 in India for instance, rising per capita incomes have led to an increase in the consumption of frozen food, meat, fish, canned and instant food items, as well as a greater acceptance of frozen vegetables.

Similar trends have been noted in China, where in increasing numbers more affluent consumers are opting for imported foodstuffs, especially seafood.

Strong growth for cold chain logistics

For cold chain pharma products, the figures are startling. In its annual Biopharma Cold Chain Sourcebook, Pharmaceutical Commerce estimates the global volume of 2017 cold chain products at $283 billion, out of a total market of $1.17 trillion, and growing at approximately twice the rate of the overall pharma market.

The International Air Transport Association (IATA), which supports aviation with global standards for airline safety, security, efficiency and sustainability, estimates that immunization prevents 2.5 million deaths every year and sees air cargo as critical for flying short shelf-life vaccines to their destination in time to be effective.

Air transportation is also critical to the economy of many regions, notably fruit‐ and vegetable‐producing countries in Africa that ship most of their produce to developed markets.

Time and Temperature Indicators (TTIs) play a key role in this process, by providing clear and unambiguous data as to whether any cold chain breaches have occurred during transit, and if so, how long they lasted. Moreover their use with certain products in certain markets are mandated by regulatory authorities, such as by the FDA for seafood imports into the US.

Managing complex logistics

That said, the transportation of cold chain perishables by air is highly complex and prone to numerous situations where temperature breaches can occur. In a study for the air transporter IAG Cargo, researchers found that over half of all temperature deviations occurred during transportation.

This data is supported by findings of the World Health Organisation (WHO), which says: “The greatest and most frequent vulnerability to temperature exposure occurs on the airport tarmac when goods are exposed to the elements before aircraft loading, or during unloading.”

Research however points to cold chain logistics managing these situations effectively for some time now. A 2012 study of Icelandic fish exported to the UK and France showed that despite poor temperature control during storage and ground operations at the airports before and after the flights, relatively a moderate increase in the temperature of the fish were recorded: the pallets of food were subjected to ambient temperatures above 10°C as well as solar radiation for several hours, but the temperature of the fish rose by less than 2°C. This was explained by the transportation of the fish inside polystyrene boxes, which were kept cool with ice inside the boxes.

It’s important to stress though that in these sorts of situations it’s only the use of temperature monitoring tools such as irreversible TTIs inside the boxes on the transported items themselves that a stakeholder can know whether potentially damaging temperature breaches have occurred.

Food loss epidemic

Nevertheless, despite much progress and professionalisation in cold chain logistics, certain problems remain difficult to resolve. One of the main costs with the transportation of perishable products such as fruit and vegetables is wastage due to spoilage related to inadequate temperature management during transit. Estimates vary as to what this amounts to, but most data suggests it is in the region of 33%.

According to the United Nations’ Food and Agriculture Organization (FAO), this wastage should be viewed as a “food loss epidemic”, which it values at about $1 trillion each year. Added to this are related environmental costs: wasted water used to produce food that is never eaten equal to the water needs of Africa, and CO2 emissions equivalent to removing every car off the road across the world.

It is hard to imagine any industry would tolerate 30-40% inefficiency.

Food bacteria grow best between 5°C and 60°C, which explains why keeping perishable products cool, cold, frozen or deep frozen is the only way to guarantee product quality and shelf-life as it arrives at the end of a transportation process.

Customers of air transport providers for perishables are well aware of this. In a survey of their various concerns, the three greatest were recorded as:

- the expertise of handling personnel

- appropriate temperature monitoring

- traceability

What is remarkable about these concerns is how they very much match those of the healthcare sector and it would seem that moving forward, it will be the lessons learnt from transporting pharma products, that could help avoid the massive cost of food spoilage during transit.

In a conference in Dallas, Texas, last year organised by the Netherlands-based Cool Chain Association, chairman Stavros Evangelakakis suggested applying healthcare industry standards to perishables would lead to wastage being “dramatically lowered”.

A post conference statement went on to stress the need to “treat perishable cargo with the same care, respect and transparency as pharma”, adding that this would be “crucial” for new and emerging markets such as South American and Africa.

Potential “quadruple win” for cold chain logistics

A recent study reported on in The Guardian highlights the huge benefits proper cold chain management can bring to the transport of perishable foods.

A carrier in India field tested cold chain equipment with a local grower for the transport of fruits in refrigerated trucks from Punjab to Bangalore, a 1,600 mile-trip over rough roads in high temperatures.

The results were significant:

- a one-week shelf life increased to two months

- profit increases by up to 23% for all the supply chain actors

- post-harvest food loss reduced by 76%

- greenhouse gas emissions reduced by 16%, excluding the significant reduction of emissions from food loss

Blueberries in January

One of the massive economic benefits of effective cold chain management is how it enables the creation of new markets.

In most countries, blueberries used to be only available at specific times of the year. The situation changed dramatically in the 1980s, with Chile harvesting blueberries from October until late March and exporting these to the US.

Today thanks to climate-controlled storage and transport technologies, the fruit is available year-round in many regions, buoyed on by the rebranding of the fruit as a “super-food”.

Today, the US is the world’s largest producer of blueberries, followed by Canada, Poland and France. Meanwhile in the UK, 2010 was the year blueberries overtook raspberries as the country’s favourite soft fruit after strawberries.

Timestrip will be attending the International Association for Food Protection – IAFP - in Tampa, Florida from 9th – 11th July 2017.

We will be demonstrating our 3°C Seafood, 5°C, 8°C & 10°C irreversible ascending temperature indicators at the exhibition. We will be at booth 847, please come and get a sample of our Nonreversible Food Temperature Indicators to test and take away with you. Click here for more information.

Food temperature monitors

Timestrip temperature monitoring labels make tracking temperature breaches across a multitude of cold chain food industry applications a simple, cost-effective process.

In fact, we offer the most cost-effective solution of our type in food standard and food safety monitoring, which is why our technology has already been adopted by a number of innovative businesses. Our precise, efficient, user-friendly temperature indicator labels are helping to ensure effective cold chain management around the world.

Each year, the International Association for Food Protection hosts an Annual Meeting, providing attendees with information on current and emerging food safety issues, the latest science, innovative solutions to new and recurring problems, and the opportunity to network with thousands of food safety professionals from around the globe. Held in various locations throughout North America, this meeting has grown over the years to become the leading food safety conference worldwide.

Time and Temperature Indicator maker Timestrip launches the Timestrip® Temperature app, a new tool that provides a visual audit trail of its temperature products.

Frame

Zoom

Focus

Snap

Using the App simply involves taking a photo of a Timestrip® label with a smartphone.

If the Timestrip® has a new style serial number, the App will recognise the serial number and allow you to register it on the system.

You can then take a follow on scan where you can enter its activation state (inert, activated or breached), storing this data with essential time and location information in the cloud.

If the Timestrip® has an old style serial number you can still use the app in the same way but you'll need to manually enter the serial number. The App is free to download from the Google Play store with an iOS version to follow shortly.

High tech low cost

The App is the latest innovation from Timestrip, which revolutionised the field of cold chain management with its unique Irreversible Time and Temperature Indicator labels (TTIs).

Recognised by the World Health Organisation and the US FDA as an essential tool for the cold chain management of blood and food products, TTIs provide data as to whether a blood or food product is safe to use. Timestrip’s irreversible TTIs make this crucial safety information unambiguous and instantly visible.

Like having a hundred permanent digital data loggers

The main benefit of Timestrip’s irreversible TTI labels is that they give essential cold chain management information on individual units of processed products. This deals with the main shortcoming of digital data loggers, which are mostly used for containers of transported and stored products.

Thanks to the new Timestrip® App, extra key information around cold chain management is added with the safe storage of status, time, journey and location data, which can be accessed at any time via the app or via a website. A digital data logger can be lost or damaged and all its data can be wiped clean. The Timestrip® App however safely stores this data in the Cloud.

Data logger functionality at a fraction of the price

Timestrip UK CEO Reuben Isbitsky says: "I am very excited about our first App, which brings Timestrip TTI labels very close to data logger functionality, at a fraction of the price. While a key benefit of Timestrip products is that they do not need external infrastructure to read and interpret, using the optional Timestrip Temperature App to scan them, adds enhanced functionality, easy audit trail and provides the customer with a permanent record of the history of the product’s journey."

Content by MW Communication

Already in 2012 the world’s third largest importer of seafood, the UN's Food and Agriculture Organization predicts that China in 2016 is set to become the world’s top destination for seafood imports. Key economic data and trends point to further growth in domestic consumption and, despite indications that the country’s economy is slowing, it has nevertheless trebled in size since 2001, with Forbes magazine predicting it will surpass the US in scale in 2018.

This growth in China’s seafood imports comes at a time when the seafood sector generally is in excellent shape, growing at a faster rate than any other protein industry with the world’s top 150 seafood companies generating $107bn in sales in 2015.

Unsurprisingly, China’s top suppliers are almost all situated around the Pacific basin. In 2013, Russia was in first place with a 17.8% share followed by the US (15.3%), Peru (12.1%), Chile (5.3%), Norway (5.1%) and Canada (4.8%), with other seafood imports being sourced from over 100 other countries. That year in value terms, its main seafood imports included flours and meals of fish, used in animal feeding ($1.7 billion); frozen Alaskan pollock ($883.6 million); frozen cuttlefish and squid ($445.9 million); and frozen cod ($434.0 million).

This astonishing growth in seafood imports is explained by a variety of factors:

Firstly, higher Chinese incomes have fuelled an increase in domestic demand: between 2001 and 2014, real wages in China rose fourfold and this trend is ongoing. Data from the Economist Intelligence Unit point to national average urban incomes rising by around 70% between 2012 and 2017, from US$6,291 to $10,791.

Moreover, this increase in domestic demand includes that for high-end seafood imports, such as lobsters come from France, Canada and the US; abalones from South Africa, Australia, and New Zealand; red shrimps from Ecuador and Argentina; king crabs from Russia and Chile; salmon from Chile, Ireland, Scotland, and Norway; and oysters from America, France, and New Zealand. Such products are obviously favoured by wealthier Chinese consumers, but the country’s emerging middle class is also demonstrating a growing appetite for these seafood imports.

An indication of this trend is the recent news report that the Russian Caviar House has begun exporting black caviar to China, with regular annual shipments of 100-150 kilograms currently being planned, according to company director Saodat Sultanova.

The second key factor explaining the growth in China’s seafood imports is that its domestic production capacity has been extremely adversely affected by pollution and thus cannot meet this increase in demand. Indeed, despite it being the world’s biggest seafood exporter, double in value terms of its nearest rival, Norway, the environmental impact of its breakneck economic growth in the last 20 years has created an insurmountable environmental obstacle.

In March this year, China’s Agriculture Minister Han Changfu said: “… the increase in China’s seafood output has come at the expense of the country’s natural environment.” Han also said that the production capacity of the country’s environment has been stretched to breaking point, with various measures undertaken this year to address the situation. These have included the launch of an effort to protect and repair its freshwater fishery resources, an increase in its annual fishing ban on the Yangtze River from three months to four and an extension to the ban to local rivers and lakes. Such actions will inevitably impact negatively on aquaculture hubs like Jiangsu and Hubei, since the Yangtze flows through those areas and means that China is having to source its seafood elsewhere.

Such environmental issues also affect the safety of China’s domestic seafood production, leading to consumers avoiding potentially harmful products.

In 2012, the Ministry of Agriculture (MOA) published administrative measures on the control of agricultural product (including aquatic) quality and safety, which included regulations on risk monitoring and sampling. Also since 2012, a further regulation is that food and beverage exporters to China are required to register through the General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ)

Despite these measures, in November 2016 it was reported that Chinese seafood retailers are increasingly nervous about stocking domestic seafood, which may have excessive traces of antibiotics. Sales outlets are also beginning to eschew selling live seafood, a choice favoured in particular by older Chinese shoppers, who traditionally bought these products from supermarkets and wet markets. Retailers say they are concerned about costly closures caused by failed safety inspections by food hygiene officials. Meanwhile central government affirmed that the safety scare wasn’t due contaminated water in live fish tanks.

This explains another key trend: the growing importance of place of origin for Chinese consumers. The market for seafood from Canada and Alaska for instance have continued to develop, with northern prawns and Canadian lobsters especially popular. Indeed, advertising the places of origin is set to become an ever more important aspect of marketing seafood imports in China, especially where the source is trusted for its rigorous temperature controls and requirements.

Demand for such products is further stimulated with Chinese consumers’ own ongoing positive experience around product quality, texture, safety, etc, all of which is inextricably linked to effective temperature control monitoring throughout the cold chain process.

The regulatory framework for importers is complex. Beyond having to satisfying country origin export regulations around documentation (commercial invoice, packing list, export health certificate, certificate of origin, etc), all products on cross- border platforms such as Kuajingtong, should meet all the requirements set by Chinese regulations, including Chinese language labelling, certification and registration standards.

Also that year, China updated its Food Safety Law, affecting ingredients, testing methods, manufacturing, contact substances, packaging, and nutrition labelling. Two important regulations, including a “Food Traceability System” and “System of Real Name” have been established and allow consumers to require a “continuous compensation”.

Lastly, Chinese regulations can change quickly and therefore it is important for importers to remain up to date with all policy changes. For example, since 2014, China has banned the imports of whole salmon, but not processed salmon.

That said, this know how around regulations is clearly not an obstacle to the many companies already exporting seafood products to China and a major trend moving forward is predicted to be around the development of e-commerce for the sale of imported seafood products.

Fan Xubing is the founder and president of Sea Bridge Marketing in Beijing and has worked for many years as a partner in promoting sales of imported seafood in China, especially online. He says that 2015 saw a rapid development of e-commerce business of imported food generally. Sales of such products including seafood have increased by over 50% and Chinese consumers are becoming accustomed to buying seafood products online.

He also says that 2016 has seen many improvements in cold chain logistics, tighter controls over temperature and more effective regulation related to seafood safety. He points to e-commerce firms such as Jingdong and Womai, which increased their investment in their cold chain logistics, and how it has become increasingly common for Chinese consumers to get the products on the day they order online or the following day.

China’s seafood import sector has been given a significant further – and often underreported – boost with the decision by central government in recent years to allow more regional cities to handle imports of perishable goods, simplifying a significant aspect of import logistics.

In the capital of comparatively wealthy Jiangsu province for instance, this has led to imports of seafood trebling and in Suzhou, which started handling seafood imports in 2015, the AQSIQ predicts more than 1,000 tons of fresh salmon will be imported into the city in 2017. The AQSIQ also reports that this year Nanjing’s Lukou Airport handled 300 tons of salmon from Chile, the Faroe Islands, the UK and Australia.

This surging demand for seafood imports has had, and will carry on having, a profound impact on cold chain logistics. According to market research by ReportLinker, in an environment where most cold chain logistics enterprises often operate both a cold storage and transportation business, the circulation in China of cold chain agricultural (including aquatic) products reached 330 million tonnes, up 16% year on year, and this is projected to double by 2020.

Visit the Timestrip Food Indicator page for solutions

Maintaining a correct cold chain is essential in managing the supply of seafood products in order to avoid contamination and food poisoning, especially from C Botulism. For restaurants and retailers, who are towards the end of a typical cold chain, ensuring this has occurred prior to delivery is a particular concern. Failure in this area can have dire consequences, both in cost and PR terms, and for consumers, they can be extremely dangerous and in some cases lethal.

C Bot seafood recall alert

In June for instance, the FDA website published an alert about a Florida-based supplier of tuna products that was obliged to initiate a US-wide product recall due to suspected C Botulism contamination of its product.

The manager of one major London restaurant says that the main ways his establishment monitors the quality of the seafood it orders are visual and olfactory inspection of the product upon receipt and the use of trusted suppliers that have the correct certification. The products are also checked upon receipt with temperature probes.

He says that a contaminated seafood product will “not look right”, that it will look “sweaty” and for fish as opposed to shellfish, that the eyes of fish that have “gone off” will look “dead looking”.

He also says that contaminated fish will have a distinct unpleasant smell and that his rule of thumb is “discard fish that smells fishy”.

He says that the scenario of the refrigerated delivery truck whose engine was switched off for a number of hours prior to delivery needn’t necessarily lead to a fall in the refrigerated ambient temperature within it as long as the truck’s doors haven’t been opened.

He adds that major points of sale of seafood products such as Billingsgate market in south-east London have power points specifically to ensure that the refrigeration units of delivery trucks are kept on, thus ensuring that the seafood products they are carrying are kept at the correct cooled or frozen temperatures.

He does concede though, that for oysters specifically, in his 40 years’ experience as a restaurant professional, statistically all restaurants that offer them will occasionally serve oysters that lead to food poisoning.

Lastly, he says that in his experience restaurants are extremely rigorous in the correct application of good food management principles and most cases of food poisoning from contaminated seafood in fact occur in private residences where there is much less awareness of these principles.

Furthermore, he says that among people who aren’t professionals of the food industry, there is also a poor understanding of food poisoning and in all suspected cases enquiries are always made about what was eaten in the previous 72 hours as invariably the cause of the incident was not what was last consumed.

Across the Channel in France, a similar approach also exists with a specialist Marseille-based seafood restaurant and retailer that has two busy branches and has been operating for over 60 years.

The manager of this business, who deals the most with quality and cold chain monitoring, says for him visual inspection of seafood products upon receipt of new stock is his most useful tool to determine whether an appropriate cold chain has been maintained.

He says fish that is spoiled due to not having been kept at the correct cooled temperature will “not feel right” and “not have the right firmness”. This, he says, occurs even before the product starts to smell bad.

He also knows that fish that is spoiled always have eyes that are not the correct colour, which is another indication that they haven't been kept at the correct chilled temperature prior to delivery.

Another aspect of how his restaurant ensures the quality of the products they serve is to only use trusted suppliers and not to deal with intermediaries. Because of these strong longstanding relationships, his business benefits from a “no questions asked” returns policy.

He also says experience is also key, pointing to the 60+ years his establishment has been in existence.

However, like his counterpart in the UK, beyond many years’ professional experience and the use of trusted suppliers and mainly visual inspection of seafood products upon receipt, no cold chain monitoring tools are used.

Both also were emphatic about stressing the value of their respective establishment’s reputation and how damaging an outbreak of food poisoning would be. This, they both said, was always one of the main issues at the front of their minds when they managed their seafood products.

However at one of Marseille’s main teaching hospitals, one senior nurse was extremely dubious about how restaurants manage and monitor seafood cold chains. Her many years’ clinical experience was that they often cut corners and few would discard products that might be spoiled, but could not be returned, due to the appropriate cold chain not having been maintained. She also said she thought this extremely worrying situation would occur even if sophisticated temperature indicators were used at all stages of the seafood cold chain.

Timestrip® has a new range of Food Temp™ indicators which have been specifically developed for food shipping and storage.

The newly designed temperature breach window on the Food Temp™ 5°C indicates breaches lasting between two to four hours.

Why 2 Hour – 4 Hours?

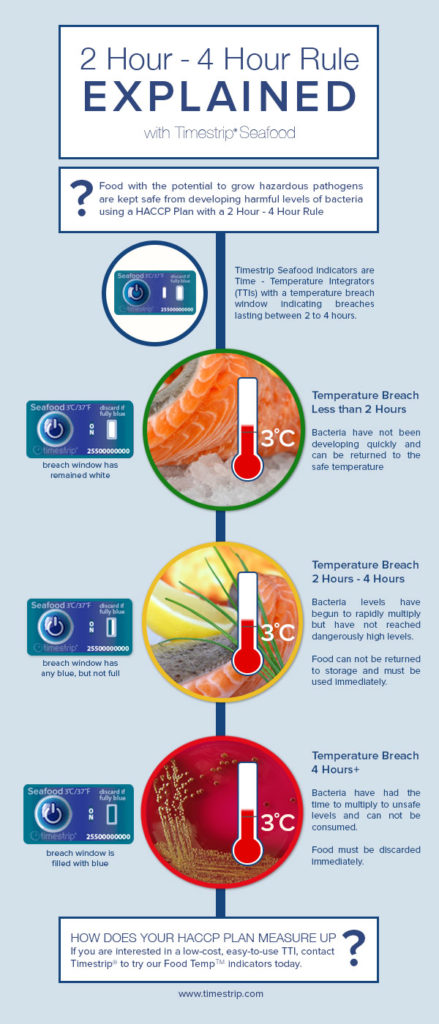

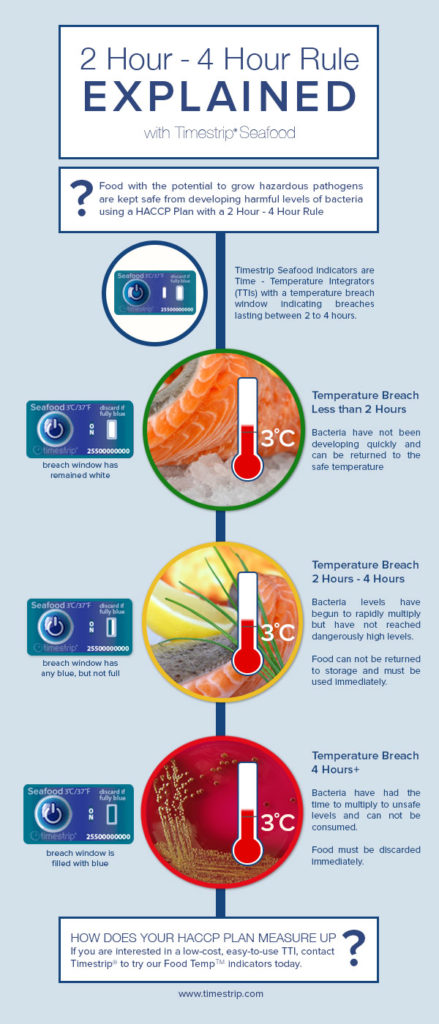

In the food industry, food with the potential to grow hazardous pathogens are kept safe from developing harmful levels of bacteria using a HACCP Plan with a 2 Hour - 4 Hour Rule.

If the food is exposed to a temperature breach for less than 2 hours, bacteria have not been developing quickly and can be returned to the safe temperature.

Users can see that the breach window on the Food Temp™ indicator has remained white and can return products to the safe temperature.

If exposed to breach temperatures above 2 Hours, but under 4 Hours- bacteria levels have begun to rapidly multiply but have not reached dangerously high levels.

When users see blue in the breach window, it will alert them they must use the food immediately and cannot be returned to storage.

After a 4 hour exposure to a temperature breach, bacteria have had the time to multiply to unsafe levels and cannot be consumed.

A completely blue window on a Food Temp™ indicator lets a user know that the food product is unsafe to use and must be immediately discarded.

For more information, see our Food Temp Indicator page.